Economics 101: Timing of Major Stock Market events

Timing of Major economic events after a 10-year/3-month yield curve inversion:

| Date of Inversion | Recession Start (Days) | S&P 500 Top (Days) | S&P 500 Bottom (Days) | Housing Market Top (Days) | |

|---|---|---|---|---|---|

| October 25, 2022 | N/A (too recent) | N/A (too recent) | N/A (too recent) | N/A (too recent) | |

| August 19, 2019 | 182 (December 1, 2019) | 14 (September 2, 2019) | 422 (March 23, 2020) | Difficult to pinpoint (Estimated Range: N/A) | |

| August 24, 2006 | 18 (December 16, 2006) | 210 (June 5, 2007) | 518 (July 2, 2009) | 396 (Estimated Range: Early 2011 to Mid-2012) | |

| February 2, 2000 | 273 (December 1, 2000) | 189 (July 18, 2000) | 1365 (October 9, 2002) | Difficult to pinpoint (Estimated Range: Mid-2001 to Mid-2002) | |

| June 30, 1989 | 120 (October 30, 1989) | 63 (September 13, 1989) | 540 (May 18, 1990) | 210 (March 1989 peak) | |

| March 29, 1973 | 150 (July 18, 1973) | 90 (June 11, 1973) | 486 (February 4, 1975) | 30 (April 1973 peak) | |

| December 13, 1965 | 90 (March 14, 1966) | 60 (February 11, 1966) | 630 (August 1969) | 90 (February 1966 peak) | |

| September 1, 1957 | 180 (March 1, 1958) | 120 (December 31, 1957) | 720 (September 1960) | 150 (February 1957 peak) | |

| May 9, 1956 | 210 (December 1, 1956) | 60 (July 17, 1956) | 810 (January 22, 1958) | 270 (August 1956 peak) | |

| July 14, 1953 | 9 (December 23, 1953) | (No recession) | 330 (April 26, 1954) | 90 (October 1953 peak) | |

| Average | 132.2 | 94.8 | 636.4 | 189.8 |

Investing in US: Types of Life Insurances - Pros vs Cons / Differences vs Similarities

"Annuity" refers to an insurance contract issued and distributed by financial institutions with the intention of paying out invested funds in a fixed income stream in the future for a certain number of years or a lifetime.

Tax Implications:

- The death benefit from a life insurance policy is not subject to income tax.

- Heirs dont have to pay taxes on the money.

- The money policy goes directly to the beneficiaries you have named on the policy, not to your estate.

- Funds do not have to go through probate or pay off any outstanding debts before reaching your beneficiaries.

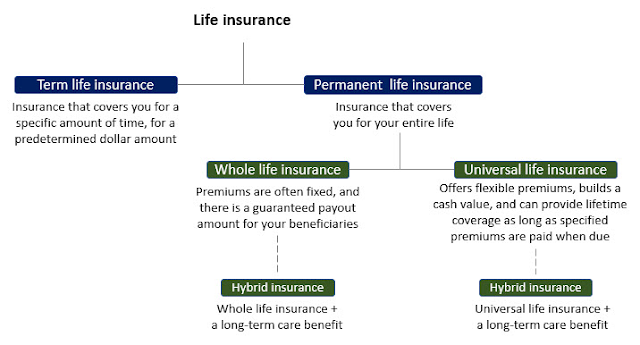

Life insurance generally falls into 2 categories: Term and permanent:

Summarized differences between term, whole, universal, and variable life insurance options in USA:

| Feature | Term | Whole | Universal | Variable |

|---|---|---|---|---|

| Death benefit | Guaranteed as 1-time lumpsum | Guaranteed in a lump sum or in installments. | Guaranteed in a lump sum or in installments. | Guaranteed in a lump sum or in installments. |

| Premiums | Low | High & Fixed | Variable. You must pay at least enough to cover the cost of insurance and the administration charges. | Variable |

| Cash value | None | Guaranteed | Guaranteed or variable | Variable |

| Investment options | None | None | Limited | Varied |

| Surrender charges | No | Yes or no | Yes or no | Yes |

| Tax treatment | Tax-deferred | Tax-deferred | Tax-deferred | Tax-deferred |

| Pros | Affordable, short-term coverage to give your loved ones a lump sum to help replace the loss of your income | Guaranteed death benefit, guaranteed cash value, low fees. eligible to earn dividends based on the company's earnings. | Flexibility, death benefit can be increased, cash value can be used for loans or withdrawals | Investment options, potential for higher returns |

| Cons | Temporary coverage, death benefit can decrease if premiums are not paid | High premiums, low investment returns. | Higher premiums than whole life, death benefit can decrease if cash value is withdrawn | Potential for losses, higher fees than whole life |

References:

Investing in US: All dividend Rules & Dates and their Significance

Disclaimer:

It is important to note that the dates below are just general guidelines. The specific dates for a particular dividend may vary depending on the company's policies. Investors should always check with the company directly to confirm the dates for any dividend that they are interested in receiving.

- Dividend-paying stocks are popular alternatives to bonds for investors who want to generate passive income.

- Retirees often invest in dividends so they can pay their living expenses without having to sell stocks.

- Dividends are distributions paid by companies on earnings to their investors.

- Investors can choose to reinvest their dividends or take them in cash.

- Qualified dividends are paid by stocks that are owned for at least the required holding period.

- Ordinary or non-qualified dividends are either Cash dividends or dividends paid by stocks that are owned for less than the required holding period.

- Like all income, dividends are subject to taxes. The tax rates depend on whether dividends are considered qualified or non-qualified.

- Ordinary or non-qualified dividends dividends are taxed at an investor's ordinary income tax rate.

- Qualified dividends are taxed as capital gains.

- Reinvested dividends are treated as if you actually received the cash and are taxed accordingly.

- Your “qualified” dividends may be taxed at 0% if your taxable income falls below $41,676 (if single or Married Filing Separately), $55,801 (if Head of Household), or $83,351 (if (Married Filing Jointly or qualifying widow/widower) (tax year 2022).

- Form 1099-DIV Dividends and Distributions is the form financial institutions typically use to report information to you and the IRS about dividends and certain other distributions paid to you.

- The financial institutions are required to fill out this form if your total dividends and other distributions for a year exceed $10. It includes information about the payer of the dividends, the recipient of the dividends, the type and amount of dividends paid, and any federal or state income taxes withheld.

- Schedule B Interest and Ordinary Dividends is the schedule you use to list interest and ordinary dividends when filing your tax return with the IRS. As far as dividends go, you only have to use this form if you have over $1,500 in taxable interest or ordinary dividends in a tax year, or if you receive interest or ordinary dividends as a nominee.

- The IRS states you must also use this form to report dividends if you are a signer on an account in a foreign country, or if you grant, transfer, or receive any funds to or from a foreign trust. You may have to use Schedule B for other situations as well.

- To report your dividends on your tax return and pay the applicable taxes, you include the appropriate amounts on Form 1040 and fill out the related line items on Schedule B if required.

- Brokerages and other companies required to report dividends on Form 1099-DIV must do so by February 1. Taxes for dividends are paid with your income tax return, due in April generally.

| Date | Name | Significance |

|---|---|---|

| Declaration date | The date on which the company's board of directors announces the dividend. | This is the first date that investors can know for sure whether or not a dividend will be paid. |

| Ex-dividend date | The date one day before the record date. | On this date, the stock price typically drops by the amount of the dividend. New buyers of the stock after this date will not be entitled to receive the dividend. |

| Record date | The date on which the company determines who is entitled to receive the dividend. | Investors must be listed as shareholders on the company's books as of this date in order to receive the dividend. |

| Payable date | The date on which the company actually pays the dividend to shareholders. | This is the date that shareholders will actually receive the dividend in their accounts. |

Investing in US: 529 Education Plan Account (crypto/stocks/ETFs) for TAX FREE GAINS forever!

- All info listed above is for informational and educational purposes only.

- Info may change from year to year. Info listed here might be out-of-date.

- This list is not comprehensive. It is provided to you with the understanding that we are not engaged in rendering tax advice.

- The information provided is not intended to be used to avoid federal tax penalties.

Following are all the points to remember for the 529 Post Tax Education investment account:

- A 529 plan is a tax-advantaged savings account designed to be used for the beneficiary's education expenses.

- Your after-tax contributions in mutual funds or similar investments grows on a tax-free basis and can be withdrawn tax-free for qualified expenses.

- Your after-tax contributions in mutual funds or similar investments grows on a tax-deferred basis and can be withdrawn by paying taxes + penalties on the withdrawal for non-qualified expenses.

- To create an effective 529 funding strategy, you’ll need to determine how much is needed to fund the lesser of the total tuition liability, or the maximum allowable withdrawal amounts so that you will end up with a $0 account balance after paying the final year of college.

- Prepaid tuition plans:

In-state public college: These plans let you pre-pay all or part of the costs of an in-state public college education. They may also be converted for use at private and out-of-state colleges.

Private College: a separate prepaid plan only for private colleges. - You can use your education savings to pay for college costs at any eligible institution, including more than 6,000 U.S. colleges and universities and more than 400 international schools.

- You must be a US resident, age 18 or over, with a US mailing and legal address, and a Social Security number or Tax ID.

- Beneficiary can even be the same person who sets up the account.

- You may not have to report anything on your federal income tax return. investment earnings in your account are not reportable until the year they are withdrawn.

- 529 plans don’t limit how long money can remain in the account. The only rule is that the account must have a living beneficiary.

- If the funds were spent on qualified education expenses or rolled into another 529 plan you don’t have to report anything.

- If 529 funds spent on purchases that do not fall into one of these two categories will be considered taxable withdrawals.

- Expenses at accredited schools nationwide in addition to tuition expenses at Vocational and trade school, university, college, online college courses, private, public and parochial elementary, high schools, K-12, certain registered apprenticeship program expenses, and student loan repayments.

- There is a $10,000 annual limit on qualified K-12 withdrawals at an elementary or secondary school. This includes public, private, and parochial schools.

- If you have leftover money in your 529 college savings plan after you graduate, you can use that money to pay off all or part of your student loan debt under a $10,000 lifetime limit on student loans.

- Not all states give tax deductions on contributions, and some consider K-12 tuition a non-qualified distribution, limiting state-tax benefits.

- If you live in one of these states – Alaska, California, Illinois, Indiana, Kansas, Kentucky, Nebraska, or Texas – you can probably use funds from your 529 plan to cover certain homeschooling expenses that meet the same criteria as tuition.

- College only expenses: books and supplies, Computers, “peripheral equipment” (like a mouse or speakers), software and internet access, course textbooks, lab materials, safety equipment, or anything else mandatory for your coursework. Special needs equipment for students with disabilities or other special needs to attend college or university.

- Room and board is considered a qualified expense if the student is enrolled at least half-time in a college, which most colleges and universities consider to be at least six credit hours per term. student must also be studying towards a degree, certificate, or another recognized credential.

- For on-campus residents, qualified room-and-board expenses cannot exceed the amount charged by the college for room and board. For students living off-campus, qualified room and board expenses are limited to the ‘cost of attendance figures provided by the college.

- Room and board costs incurred for abroad programs count as long as it’s approved for credit by your home college or university.

- You can’t use prepaid tuition plans like the Private College 529 Plan to pay for room and board.

- 529 plans dont cover costs for a student’s Extracurricular activity fees, College application and testing fees, private tutoring costs, health insurance and transportation costs are not qualified expenses, unless the college charges them as part of a comprehensive tuition fee or the fee is identified as a fee that is “required for enrollment or attendance” at the college.

- 529 plans dont cover Expenses used to generate federal education tax credits such as the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Tax Credit (LLTC)

- If you made non-qualified purchases last year, you will need to review your 1099-Q, which breaks out the basis portion and the earning portion.

- The basis/initial-principal portion will never be taxed or subject to penalty because it is made up with the amount you originally contributed with after-tax dollars.

- 529 plan withdrawals must happen in the same tax year as the expenses that are incurred.

- Once you’re ready to start taking withdrawals from a 529 plan, most plans allow you to distribute the payments directly to the account holder, the beneficiary, or the school.

- Unlike a custodial account, with a 529 plan the account owner maintains ownership of the account, can make investment decisions, and can even change the beneficiary if plans change until the money is withdrawn.

- As long as the money stays in the account, no income taxes will be due on earnings.

- When you take money out to pay for qualified education expenses, those withdrawals may be federal income tax-free—and, in many cases, free of state tax too.

- You may also qualify for a state tax benefit, depending on where you live. More than 30 states offer state income tax deductions and state tax credits for 529 plan contributions.

- You can invest in any 529 plan that is considered to be a nationwide plan. You do not have to be limited to the plan sponsored by the state where you live.

- Nearly all (30) states sponsor 529 plans to offer a full or partial tax credit or deduction that are managed by a variety of financial partners. Most states only offer this benefit to residents who use their home state’s plan

- Most states offer nationwide plans where anyone can open an account. A handful of 529 plans are only for state residents; applicable to: Florida, Louisiana, New Jersey, South Carolina, South Dakota, and West Virginia.

- Some states offer their Residents a state income tax deduction when they contribute to any state’s 529 plan; applicable to: Arizona, Arkansas, Kansas, Minnesota, Missouri, Montana and Pennsylvania

- Each state also has an aggregate contribution limit for 529 plans, which ranges from $235,000 to $550,000. This amount is based on the price of attending an expensive college and graduate school program, including textbooks and room and board.

- Withdrawals from a 529 plan account can be taken at any time, for any reason. But, if the money is not used for qualified education expenses, federal income taxes may be due on any earnings withdrawn. A 10% federal penalty tax and possibly state or local tax can also be added.

- There are exceptions to the 10% penalty—for instance, if the beneficiary receives a scholarship or attends a US military academy or The account beneficiary dies or becomes disabled. earnings/profits would still be subject to federal income tax and any state and local taxes.

- The penalty on non-qualified 529 plan distributions is 1-3% of the distribution amount – no worse than investing in a taxable savings account.

- Taxable/Penalized earnings = Total Earnings - Non-Taxable Earnings = Total Earnings - ((Qualified Expenses)/(Total Distribution)) x (Earnings Portion)

- Assets held in the 529 plan receive favorable treatment on the Free Application for Federal Student Aid (FAFSA), and distributions are not reported.

- There may be a greater impact on aid eligibility when a grandparent or other third party owns the 529 accounts. In this case, assets are not reported, but distributions used to pay for college are considered cash support to the student. This can reduce the student’s eligibility for need-based aid by as much as 50% of the amount of the distribution.

Plan ahead!

Investing in US: HSA Account for Health Expenses & PRETAX Investment Gains!

STEPS:

- Your yearly income before paying taxes is called "gross" or "total" income.

- From this amount, you can contribute a maximum of $3.65k/yr = $0.3k/month into your HSA (Health Savings Account).

- Good HSA account providers allow investments in crypto/stocks/bonds/ETFs, etc.

- Choose the investment of your choice and start making monthly or yearly contributions.

- It is recommended that you pay for your health expenses out-of-pocket instead of HSA so that your PRETAX investment in your HSA account can grow without withdrawls.

- It is recommended that you keep all your health expenses receipts with you for later withdrawls in life when you need liquid cash from your HSA account.

- Remember, you're saving money because no federal (and most state/local) taxes are taken out of your contributions initially or ever (for qualified health expenses).

WITHDRAWL RULE for Roth IRA INITIAL INVESTMENT:

You can use your HSA to pay for eligible health care, dental, and vision expenses for yourself, your spouse, or eligible dependents (children, siblings, parents, and others who are considered an exemption under Section 152 of the tax code).

- pay both penalty+tax: Any age, if not withdrawing for qualified Health Expenses.

- penalty+tax free: Any age, if withdrawing for qualified Health Expenses.

- pay taxes only: age > 65 if not withdrawing for qualified Health Expenses.

- All info listed above is for informational and educational purposes only.

- Info may change from year to year. Info listed here might be out-of-date.

- This list is not comprehensive. It is provided to you with the understanding that we are not engaged in rendering tax advice.

- The information provided is not intended to be used to avoid federal tax penalties.

Investing in US: Roth IRA Account (crypto/stocks/ETFs) for TAX FREE GAINS forever!

BASIC STEPS:

- After you have paid taxes on your income, you get an in-hand post-tax income/profit.

- From this amount, you can contribute a maximum of $6k/yr = $0.5k/month into your Roth IRA account.

- Good Roth IRA account providers allow investments in crypto/stocks/bonds/ETFs, etc.

- Choose the investment of your choice and start making monthly or yearly contributions.

WITHDRAWL RULE for INITIAL INVESTMENT (PRINCIPAL):

- pay both penalty+tax: age < 59½ & its NOT been 5years since your contribution

- penalty+tax free: age 59½+ & its been 5years since your contribution

- pay taxes only: age 59½+ & its NOT been 5years since your contribution

EXCEPTION WITHDRAWL RULES for Roth IRA PROFITS:

- penalty+tax free for exceptions: age < 59½+ & its been 5years since your contribution

- pay taxes only for exceptions: age < 59½+ & its NOT been 5years since your contribution

- First-time home purchase (up to a $10,000 lifetime total maximum withdrawl allowed)

- Qualified education expenses (college, etc.)

- Birth or adoption expenses

- You become disabled or pass away

- Medical expenses not reimbursed by your Health Insurance

- If unemployed, then health insurance costs

- How to Get all your Traditional/Roth IRA money for 60days once a year:

- Request Traditional/Roth IRA Transfer (nontaxable rollover)

- Request check be made payable to you,

- Now you have up to 60 days to deposit that check into another IRA

- This process has no taxes or penalties and is useful when you need liquid cash quickly.

- All info listed above is for informational and educational purposes only.

- Info may change from year to year. Info listed here might be out-of-date.

- This list is not comprehensive. It is provided to you with the understanding that we are not engaged in rendering tax advice.

- The information provided is not intended to be used to avoid federal tax penalties.

Personal Finance 101: How to Reduce your Taxable Income Legally

Following are all the ways in which you can reduce your yearly taxable income:

PROTIP Section 0: Use your standard deductions

This depends on your marital status and number of dependents.

File your taxes ASAP as that starts your Audit timeline early

If your tax return does have errors, the timeframe in which the government has to prove your fault starts decreasing earlier.

PROTIP Section 1: Maximize Pre-Tax & Post-tax Contributions

A) Retirement plan (PRE-TAX) for yourself:

401k from employer &/or self created IRA for self:

If you are age <50: $23k/yr = $2k/month

If you are age >50: You can contribute an additional $6k/yr = additional $0.5k/month

B) Retirement plan (PRE-TAX) for your non-working spouse:

Self created IRA for spouse (not via employer or government):

If you are age <50: $6k/yr = $0.5k/month

If you are age >50: You can contribute an additional $1k/yr

C) Health Savings account (PRE-TAX) for healthcare expenses:

HSA from your health insurance company:

If you dont have a family and are of age <55: $4k/yr = $305/month

If you do have a family and are of age <55: $8k/yr = $600/month

If you are age >55: You can contribute an additional $1k/yr

D) Roth IRA (POST-TAX) for Forever tax free profits:

Never pay taxes on profits from Roth IRA (crypto/stocks) by contributing:

$6k/yr = $0.5k/month from your PostTax paycheck

FINALLY; After all deductions (401k, Spouse-IRA, HSA, Roth IRA) -

- Your PostTax income will reduce by a total of $29k/year = $2.4k/month

- This reduces your total tax load by $8.7k/yr which yields a profit of 40%+ 😎

- This 40% profit is achieved by paying $8.7k/yr lesser taxes vs only a $20.3k reduction in post tax income.

- Every dollar saved in taxes is equal to 1.3x in salary terms. $8.7k saved means ($8.7*1.3x) = $11.3k of salary gained/saved.

- By having untaxed money in these old-age/health accounts, you maximize your principal/initial investment to gain profits from these as much and as early as possible.

OTHER PRE-TAX DEDUCTIONS:

- Healthcare, Dental & Vision Insurance Cost

- Medical Expenses and Flexible Spending Accounts

- Life & Supplemental Insurance Coverage

- Short-Term & Long-Term Disability

- Child Care Expenses

- Commuter Benefits

PROTIP Section 2: Maximize your Non-taxable income

(no need to add these to your tax return)

- Inheritances, gifts and bequests

- Cash rebates on items you purchase from a retailer, manufacturer or dealer

- Alimony payments (for divorce decrees finalized after 2018)

- Child support payments

- Most healthcare benefits

- Money that is reimbursed from qualifying adoptions

- Welfare payments

- Money you receive from a life insurance policy when someone dies

- Money from a qualified scholarship for non-personal expenses

- Credit card bonuses/cashbacks

- Retail gift cards

PROTIP Section 3: Get Married

(If you're legally married as of December 31 of the tax year, the IRS considers you to be married for the full year.)

if the taxpaying spouses have substantially different salaries, or if only one spouse earns; the lower one can pull the higher one down into a lower bracket, reducing the couples' overall taxes.

C) Use Spouse's income to increase Total IRA contributions:

Couples filing jointly can make contributions to two separate IRA accounts – one for each spouse where the unemployed spouse (taxpayer with SSN), can contribute to an IRA using their spouse's income.

D) Increase primary residence sale tax-free profit limit from $250,000 to $500,000:

To qualify for the larger $500,000 tax-free gain, both spouses must have lived in the home for at least two of the last five years, and at least one spouse must have owned the home for at least two of the last five years.

1) If filing jointly:

- Marriage penalties typically occur when the tax brackets, standard deductions, and other aspects of the tax code available to married couples aren't double those available to single taxpayers.

- Once you sign the joint return, you are fully responsible for every number that’s in it. If your spouse fudges a figure, you’re equally liable for the consequences.

- However, you aren’t responsible for your spouse’s mistakes or deliberate omissions if they happened in the years before you married or if you can prove that you didn’t know about them.

- It might be harder to reach the higher minimum percentages of income necessary to be able to deduct medical expenses (in 2022, it must be greater than 7.5% of Adjusted Gross Income), given the combined income, unless one or both of you had significant health care expenses.

- If there’s a garnishment for an unpaid loan or child support against a spouse, a refund could be delayed or blocked.

- You can't claim the Earned Income Tax Credit or the Child and Dependent Care Credit unless you meet specific requirements for married but separated parents.

- You can't claim education credits, including the American Opportunity Credit and the Lifetime Learning Credit.

- You can't deduct student loan interest.

- If one spouse itemizes deductions, both must itemize — even if the standard deduction would result in a lower tax bill for the other spouse. You can't mix and match.

A) Deduct your house loan interest payments:

CONDITION 2: You need to be making payments towards your loan interest for this deduction.

B) Claim both your parents as dependents:

CONDITION 1: Your parents/dependents will need their ITIN numbers for you to claim this deduction.

CONDITION 2:If your parents/dependents are immigants, they have to stay with you at your home for minimum 6 months for you to list them as dependents on your tax return for that year):

C) S corp deductions:

CONDITION 1: Only If you are a consultant or have your own firm/business.

CONDITION 2: You can only deduct your work related expenses and firm/business losses from your taxable income.

CONDITION 3: If you have made taxable profits from your firm/business, you need to find the net loss/profit and report the same to the IRS.

- U.S. savings bonds: U.S. savings bonds are a type of government bond that offers tax-deferred growth. When you buy a U.S. savings bond, you pay a discounted price, and the bond matures at a higher price. The difference between the purchase price and the maturity value is the interest you earn on the bond. Interest on U.S. savings bonds is not taxed until the bond matures or you cash it in.

- Series EE savings bonds: Series EE savings bonds are a type of U.S. savings bond that offer a guaranteed rate of return. The rate of return is fixed when you buy the bond, and it does not change over time. Series EE savings bonds are a good option for investors who are looking for a safe and secure investment with a guaranteed rate of return.

- Series I savings bonds: Series I savings bonds are a type of U.S. savings bond that offer a variable rate of return. The rate of return is composed of a fixed rate and a variable rate that is indexed to inflation. Series I savings bonds are a good option for investors who are looking for an investment that will keep pace with inflation.

- Treasury Inflation-Protected Securities (TIPS): TIPS are a type of U.S. government bond that is indexed to inflation. The principal amount of a TIPS bond increases with inflation, and the interest payments are also adjusted for inflation. TIPS are a good option for investors who are looking for an investment that will keep pace with inflation.

- Municipal bonds: Municipal bonds are bonds issued by state and local governments. Interest on municipal bonds is typically exempt from federal income tax, and it may also be exempt from state and local income tax. Municipal bonds are a good option for investors who are looking for a tax-advantaged investment.

- Real estate investment trusts (REITs): REITs are a type of investment that invests in real estate. REITs can be a good option for investors who are looking for a tax-advantaged investment that can provide income and growth by offering a qualified (lower) dividend tax rate. To qualify for the qualified dividend tax rate, the dividends must be paid by a U.S. company or a REIT.

- 0% for taxpayers in the 10% or 12% tax bracket.

- 15% for taxpayers in the 22% or 24% tax brackets

- 20% for taxpayers in the 32%, 35%, or 37% tax brackets

- All info listed above is for informational and educational purposes only.

- Info may change from year to year. Info listed here might be out-of-date.

- This list is not comprehensive. It is provided to you with the understanding that we are not engaged in rendering tax advice.

- The information provided is not intended to be used to avoid federal tax penalties.